Posted: September 5, 2013

Contributing Authors: Miranda Lim

Eyes have been on BlackBerry for the past several weeks, as the company announced the formation of a special committee to explore strategic business alternatives, including a possible sale of the company. While BlackBerry is still evaluating the options for the future of the company, many analysts are already looking into its valuation. Of particular interest is the patent portfolio of this smartphone pioneer and dominant player in Canada’s technology community.

Scotiabank analyst Gus Papageorgiou estimated the worth of BlackBerry patents at $4.26 per share (The Globe and Mail, 14 Aug. 2013) which would amount to more than $2 billion, half of the famous $4.5 billion Nortel patent portfolio sale. To answer the questions of what these patents are about, and who might be interested in them, Chipworks has taken a closer look at the BlackBerry patent portfolio.

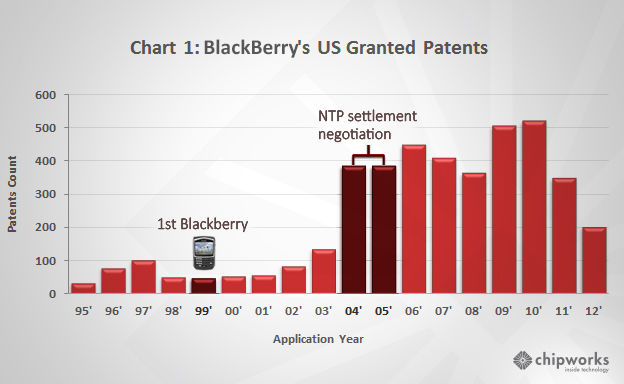

As shown in chart 1 below, BlackBerry started to build up its US patent portfolio in the mid '90s - even before the first BlackBerry device was introduced in 1999. Not unexpectedly, overall patent filings have grown since 2004, a time period referenced by the now famous NTP vs BlackBerry patent litigation case and the overall recognition of BlackBerry to bolster its patent portfolio.

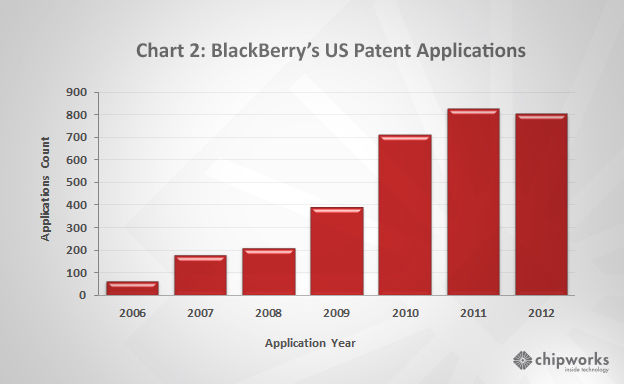

BlackBerry is currently estimated to own 7500 US patents, of which the majority (4200) are granted patents (chart 1 above), and the remaining 3300 are US applications published from 2008 onwards (chart 2 below). Notably, 42% of the portfolio has also been filed in other jurisdictions, including Europe and China, providing BlackBerry with worldwide protection for its intellectual property.

Eighty percent of BlackBerry's portfolio appears to originate from within the company itself. The remaining have been obtained through company or patent acquisitions. The most well-known of these acquisitions are the Nortel patents through the Rockstar deal, and QNX, which provided the foundation operating system for BlackBerry 10. We will talk about these two companies in terms of their added value to BlackBerry later in part 3 of this blog. First, let’s take a look at the BlackBerry portfolio from a technology perspective.

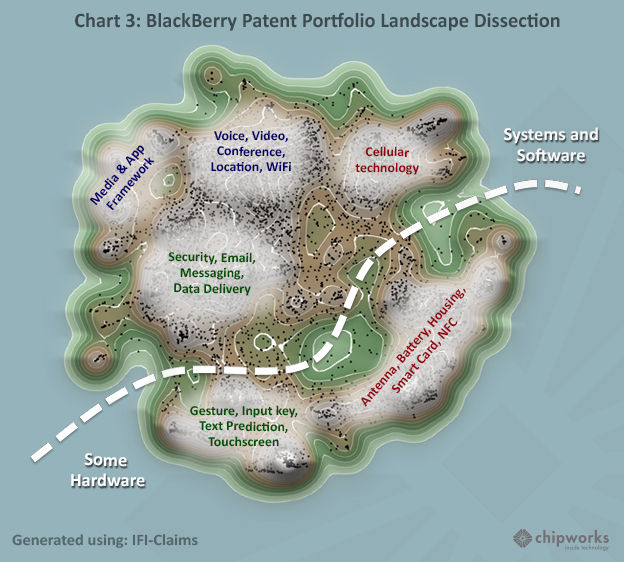

Chipworks performed a landscape analysis of the BlackBerry portfolio in order to unveil its technological composition. See chart 3 above. Each dot represents a US patent or application. Patents in proximity to each other share similar words. Peaks are formed in the landscape where there is a high concentration of similar patents in a related technology area. The peaks have been annotated with text bubbles in order to illustrate the patent groupings.

BlackBerry patents can be divided into three main technology areas, each with two patent groupings. They are handheld design technologies (red), multimedia platform (dark blue), and the key differentiating features of BlackBerry (green). Most of BlackBerry’s patents describe systems and software, the remaining 10% represent hardware patents related to handset design, which are scattered to the right of the white line in the map.

Next week in part two, we’ll take a closer look at these technology areas in terms of the type of technology that comprise each category, how it may relate to BlackBerry’s overall business direction, and what type of industries and companies might be interested in it.