Mate 60 Pro mobile RF architecture proves Huawei can compete with top-tier smartphone OEMs

While there are many OEMs and brands of smartphones, only a handful of application processor/baseband (AP/BB) vendors serve the whole market: MediaTek, Qualcomm, and Samsung have the worldwide majority share with the native Chinese companies Huawei/HiSilicon and Unisoc fighting the geopolitical embargo on the large, but less lucrative, Chinese internal market.

MediaTek, Qualcomm, and Samsung don't just produce chipsets, they offer complete platforms based on their AP/BB chipsets, from the modem to the RF (antenna) design and architecture. This has led to a competitive landscape where companies like Avago/Broadcom, Murata, Qorvo, Qualcomm, and Skyworks dominate the RF Front-End (FE) market. Chinese competitors, lagging in technology and performance, find little room to compete here.

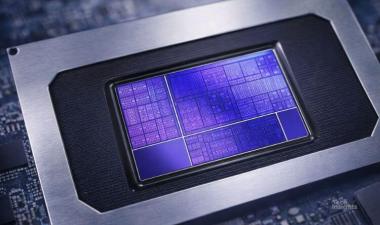

However, TechInsights’ continued analysis of the Huawei Mate 60 Pro reveals significant progress by China in bypassing technological embargos. This progress isn't just in the application processor system-on-chip (SoC) but also in the 5G BaseBand processor and mobile RF technologies.

China has also made leaps in developing advanced (2D) system-in-package (SiP) modules and RF filters, using improved techniques in acoustic wave filters and hybrid technology based on thin-film integrated passive device (IPD) and low-temperature cofired ceramics (LTCC). This is a significant step from previous RF FE 5G architectures dating back to 2015 and 2016.

While the Mate 60 Pro shows China narrowing the technological gap with Western competitors, it hasn't completely closed it in 2023. However, given the Chinese government's focus on reducing dependence on Western technology, this gap is expected to continue narrowing. Read more on this development in the TechInsights Platform.