Posted: September 08, 2016

Contributing Authors: Ray Angers

Speculation about who will acquire analog semiconductor manufacturer Intersil is high in the latest chapter of the 2016 Mergers and Acquisitions story. Reports indicate that Japan’s Renesas, a leader in the automotive IC market, currently has offered US$3B for the Milpitas-based company. While Intersil’s automotive product sector accounted for only 12% of the total US$522M reported revenue, it is growing fast and Renesas is looking to diversify their position in that market. Maxim is also rumored to be making a play for Intersil. They too manufacture analog integrated circuits targeting the automotive and industrial markets, however, they are quite a bit smaller than Renesas, with about a third of the revenue and a quarter the number of employees. Maxim is hoping the fact that some Intersil products are used in military applications improves their chances of success, which would increase scrutiny by US regulators of a foreign takeover. Of course, the technology owned by organizations also factor into merger decisions, so let’s examine the underlying IP of these three companies to see who might benefit more from the acquisition of Intersil.

Patent Analysis

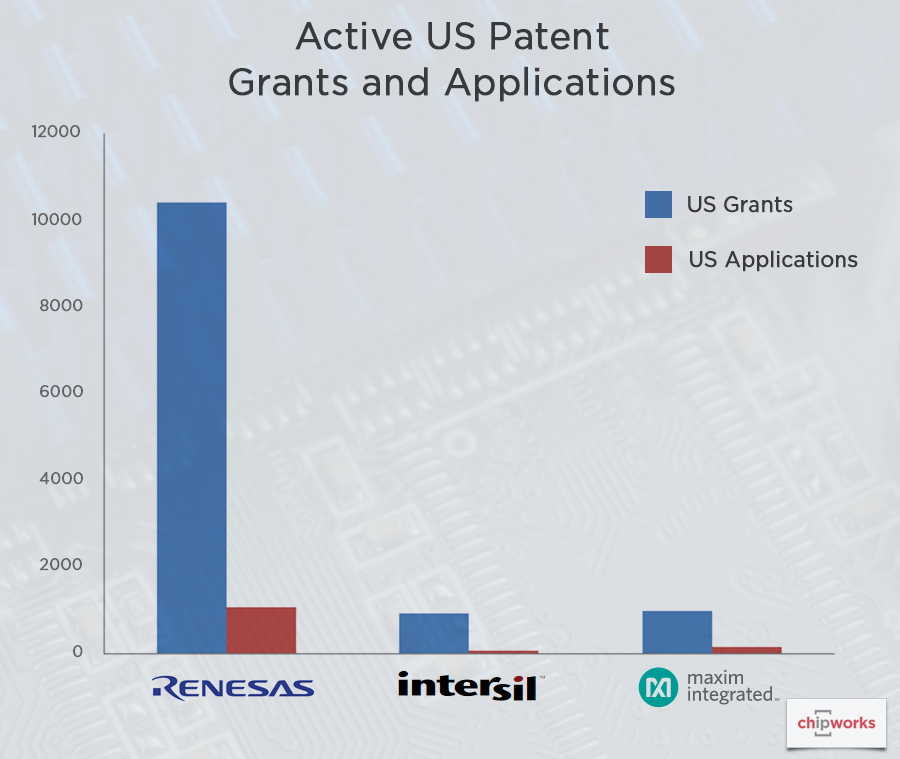

As stated above, Renesas is a large company, and this is reflected in their patent holdings. Renesas has roughly ten times the number of US granted patents as either Maxim or Intersil.

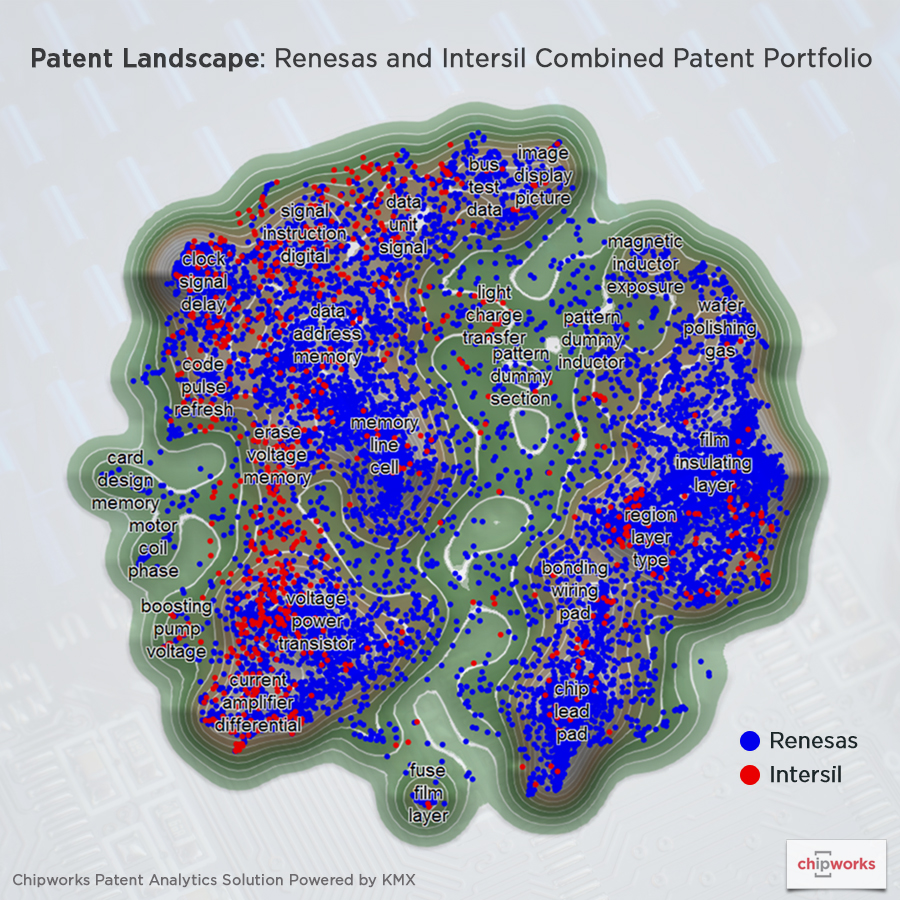

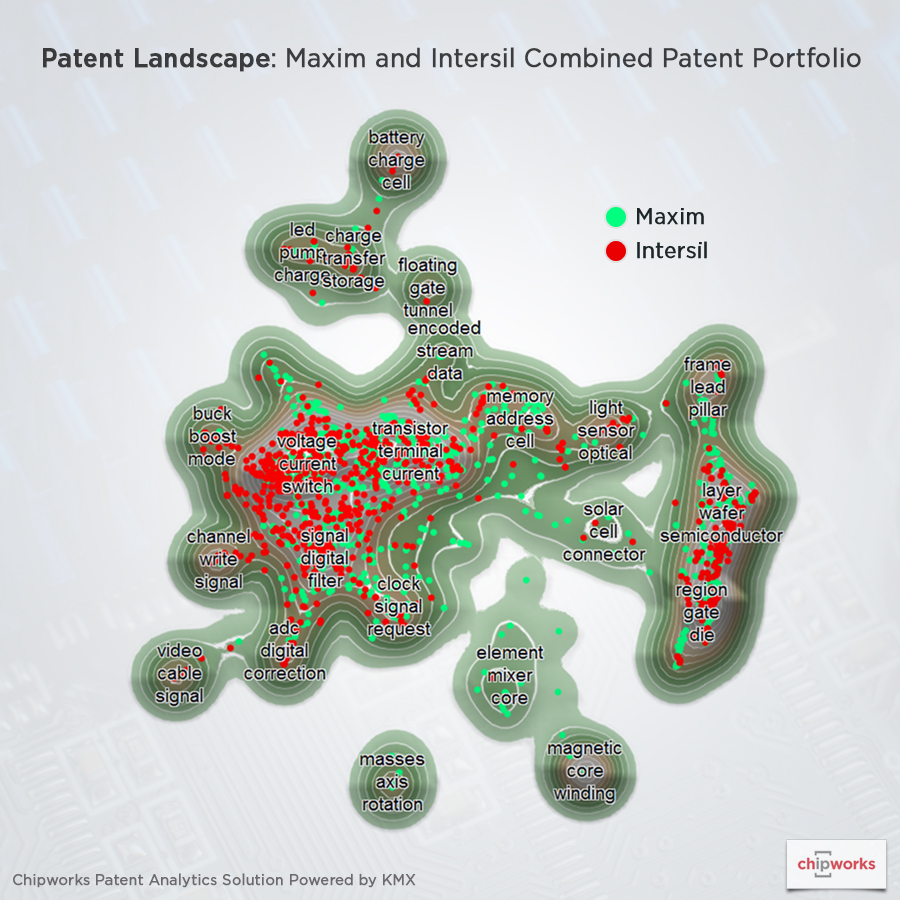

Using TechInsights' Patent Analytics Solution Powered by KMX, we analyzed these combined portfolios and created patent landscapes to compare the hypothetical Renesas/Intersil and Maxim/Intersil entities. Each dot on the landscape represents a US patent grant or application. The text algorithm built into KMX groups patents similar in concept together on the landscape. Topographical peaks denote key technology concepts, with the top three most frequent words for each peak shown.

Looking first at the combination of Renesas and Intersil, we note the dominant IP position that Renesas has based on sheer numbers. Based on the keywords, we see that patents related to circuits and systems reside predominantly on the left of the landscape. Interestingly, Intersil’s patents (colored red) cover a fairly significant portion of this area, with one notable exception being memory. Meanwhile, patents dealing with process and packaging technology are generally found on the right side of the landscape, and Renesas dominates much of this space. Neither company has any significant presence in semiconductor manufacturing and instead outsource production to advanced foundries, however, both continue to publish in this area.

The combination of Maxim and Intersil is a little more equitable, each contributing about 1000 US grants to the mix. In this case, we see very complementary IP portfolios. With the exception of some niche areas on the landscape (the lower region related to MEMS technology covered only by Maxim, for example), both companies appear to be innovating in similar areas. Again, the IP is focused on circuit patents.

Market Analysis

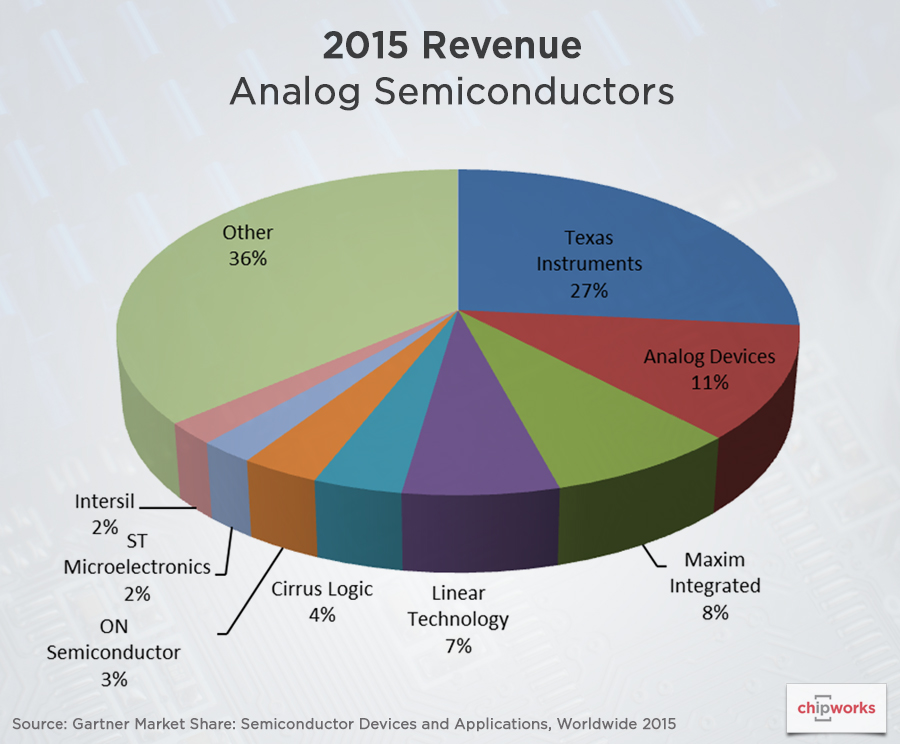

Intersil is an analog semiconductor manufacturer from a product offering perspective. According to Gartner Market Research, data components such as amplifiers, data converters, voltage regulators, interface, and timing chips account for almost 90% of their 2015 revenue. The market leaders in this space, Texas Instruments and Analog Devices, account for almost half of the total market share for analog components (including Linear Technology, which was acquired by ADI back in July). Maxim held the number 3 position in 2015, with 8% of the market share, so while acquiring Intersil would not change this position, it would help narrow the revenue gap. If Renesas can manage the regulatory hurdles and acquire Intersil, they would gain a presence in a market where they are currently ranked 32nd. While Renesas has the means to buy its way into the analog market, the price to acquire Maxim is considered to be too high, with both Texas Instruments and ADI apparently backing out of talks earlier this year.

Conclusion

Examination of the patent portfolios suggests that, from a technology point of view, neither Renesas nor Maxim would derive significant benefit from the acquisition of Intersil, apart from broader coverage in areas in which they are already innovating. We conducted a similar analysis last year when both Microsemi and Skyworks were courting PMC-Sierra. There, we determined that PMC’s IP in the big data space would be more beneficial to Skyworks by helping them push into that market. It was the shareholders who prevailed over the technologists and Microsemi won with a sweetened offer. In this case, it’s all about business and market share. Maxim would solidify its presence in one of its most important markets, while a successful bid by Renesas would vault it into the top 10 analog semiconductor manufacturers.