2025 Memory Outlook Report

Unlock AI-Driven Trends Shaping the Memory Market

As we move into 2025, the memory industry is being reshaped by the rapid rise of artificial intelligence (AI). The TechInsights Memory Outlook Report 2025 provides an in-depth analysis of how AI is driving growth in high-bandwidth memory (HBM), increasing the demand for quad-level cell (QLC) SSDs, and shifting capex investments across DRAM and NAND. Discover how these trends will affect supply chains, pricing, and procurement strategies.

Enter your email below to register for FULL 2025 Memory Outlook Report, available exclusively in the TechInsights Platform.

![]() 25,000+ memory technology professionals started a free trial in the last 30 days

25,000+ memory technology professionals started a free trial in the last 30 days

Five Key Market Expectations for 2025

The memory market in 2025 is set to be significantly impacted by the growth of AI, driving major changes in both DRAM and NAND sectors.

Here are the five key market trends to watch:

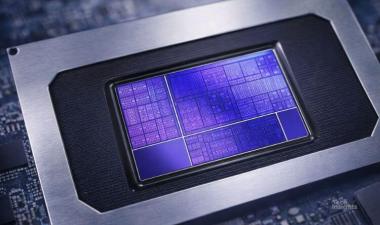

AI Leads to Continued Focus on High-Bandwidth Memory (HBM)

AI’s growth is propelling demand for High-Bandwidth Memory, with HBM shipments projected to rise 70% year-over-year. This surge is reshaping the DRAM market, as manufacturers shift focus to HBM. Discover how this trend will impact memory production and supply.

AI Drives Demand for High-Capacity SSDs and QLC Adoption

As AI workloads expand, the need for high-capacity SSDs is increasing. QLC NAND, with its cost-effective, high-density storage, is set to lead the charge, driving over 30% datacenter NAND growth by 2025. Learn how AI is influencing SSD technology and storage demands.

Capex Investment Shifts Heavily Towards DRAM and HBM

Capital investment is shifting heavily towards DRAM, particularly HBM, as AI workloads demand memory-intensive solutions. This shift may cause supply issues in NAND production. Find out how this investment trend could impact the memory market in the coming years.

Edge AI Begins to Emerge but Won’t Impact Until 2026

Edge AI is set to debut in 2025, bringing AI closer to devices like smartphones. While its full impact on memory demand won’t hit until 2026, the groundwork is being laid. Explore what’s ahead for Edge AI and its role in shaping future memory markets.

Datacenter AI Focus Delays Traditional Server Refresh Cycles

AI-focused datacenters are delaying traditional server upgrades, leading to a potential surge in future DRAM and NAND demand. Find out how this delayed refresh cycle could result in a significant memory market shift.

Key Chapters at a Glance: Unlocking 2025 Memory Market Insights

As the memory market enters 2025, it's critical to understand the AI-driven forces that are reshaping supply, demand, and technological innovation. Our Memory Outlook Report 2025 delves into the most important trends affecting DRAM, NAND, and emerging memory technologies, offering detailed insights across key areas such as market shifts, procurement strategies, pricing forecasts, and technical advancements. Explore these chapter highlights for a comprehensive view of the upcoming challenges and opportunities in the memory industry.

Market Outlook

In 2025, AI will drive major shifts in the memory market. High-Bandwidth Memory (HBM) is set to grow 70% year-over-year, transforming the DRAM market as manufacturers prioritize HBM production. Meanwhile, datacenter NAND demand is expected to rise by over 30%, though NAND supply bottlenecks could emerge as investment focuses on DRAM.

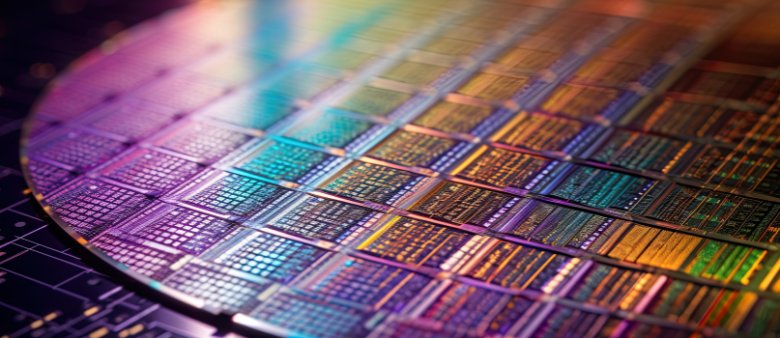

Technical Outlook

AI is pushing innovations in DRAM and NAND technology. Expect advancements in HBM3, DDR5, and 3D NAND with 500+ layers using hybrid bonding. Emerging technologies like STT-MRAM and ReRAM are also gaining momentum, especially in embedded systems with next-gen nodes.

Procurement Outlook

Procurement will face challenges as capex shifts towards DRAM and high-bandwidth memory. This shift may lead to longer NAND lead times, making it crucial for companies to plan for tighter supply conditions in 2025.

Memory Price Outlook

Memory prices in 2025 will fluctuate. DRAM prices are expected to rise, driven by increased demand for AI applications. NAND pricing could be volatile due to production constraints and datacenter demand.

Memory Lead Time Outlook

Lead times for both DRAM and NAND are expected to extend in 2025. DRAM manufacturers will focus on HBM, while slower NAND investment may create delays. Businesses should adjust procurement timelines accordingly to avoid disruptions.

A Sudden Halt in AI Development Could Upset Everything

AI is the driving force behind the rapid growth in the memory markets, but what happens if that momentum suddenly slows? Macroeconomic challenges, investment slowdowns, or technical roadblocks could drastically reduce demand for HBM, DRAM, and SSDs.

Explore how a shift in AI’s trajectory could disrupt the expected growth in memory markets and reshape future investments.

Supreme Court Strikes Down IEEPA Tariffs | Semiconductor Impact

The Supreme Court invalidates IEEPA tariffs as the U.S.-Taiwan trade deal reshapes semiconductor import policy. Read the TechInsights report.

Chip Observer: CES 2026, AI Power Plays, and a $48B M&A Surge

CES 2026 semiconductor news: AI PCs, Snapdragon X2 Elite, $48B in M&A, ZAM memory, and a 2026 forecast projecting a $1 trillion chip market.

Intel Panther Lake on Intel 18A: Strategic & Geopolitical Analysis

Explore Intel Panther Lake on Intel 18A, examining advanced-node execution, IDM 2.0 credibility, and strategic implications for the global semiconductor ecosystem.