Posted: September 18, 2013

Contributing Authors: Miranda Lim

In Parts 1 and 2, we reviewed the breakdown of BlackBerry’s patent portfolio. We also took a closer look at how the portfolio breaks down from a technology perspective into three main areas: handheld design technologies, multimedia platforms, and the key differentiating features – sharing observations of the types of companies/markets that may be interested in them.

This week, we look at the potential impact of major acquisitions, such as Rockstar and QNX, on both the BlackBerry portfolio and on potential market directions for the company.

Having dissected the BlackBerry portfolio from a technical viewpoint, let's go back to the discussion of Rockstar and the QNX acquisition. BlackBerry participated in the Nortel patent auction back in 2011 and has ultimately become one of the co-owners of the Rockstar Consortium, to which the Nortel patents were reassigned. Rockstar has since transferred some patents back to individual shareholders, with some landing in the BlackBerry's patent pile.

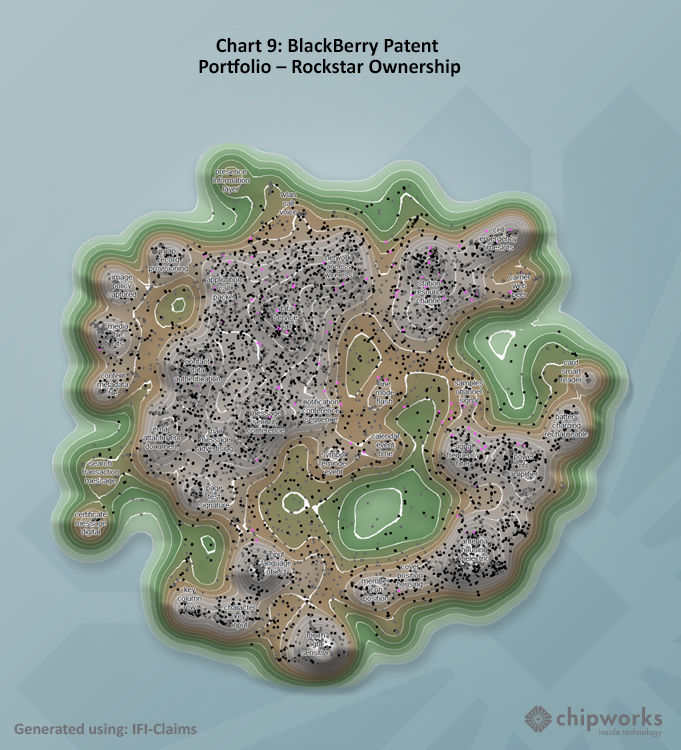

Chipworks has identified 120 patents in the BlackBerry portfolio that are believed to have come from Rockstar. See chart 9 below. Each dot in the chart represents a patent or an application. The pink dots represent Rockstar patents. As can be seen, the Rockstar patents are not lumped into a single group, but rather are distributed throughout BlackBerry's portfolio. This may be an indication that the acquisition of these patents were for purposes other than covering technological gaps in the company's inventions.

Given the small percentage (< 2%) of Rockstar patents in BlackBerry's overall portfolio, they may only be of incremental value to BlackBerry. As BlackBerry is considering selling its stake in the Rockstar Consortium, it could also consider selling these patents.

BlackBerry's most famous company acquisition is QNX Software Systems, the creator of the operating system engine behind BlackBerry 10. Prior to its life as a subsidiary of BlackBerry, QNX was in business for over 30 years and is well known for the use of its OS in the automotive industry. Last month, the company announced that it will be supplying Panasonic Automotive Systems Company of America with vehicle infotainment software (Ottawa Citizen, 14 Aug. 2013). This is another sign that the automotive infotainment business is going to be another huge area of growth in the coming years.

The question then is whether the acquisition of QNX has added any valuable patents to BlackBerry in this domain? Looking at the BlackBerry portfolio itself, it appears to contain only three applications that may have come from QNX. Most of the QNX patents do not appear to have been reassigned to BlackBerry based on our preliminary investigation. Chipworks has found around 130 QNX patents under the ownership of QNX. The patents are heavily concentrated on noise suppression, wind noise suppression, speech detection, video streaming/playing, file system organization for media storage, and cooling systems for computing devices – inventions applicable very much, though not exclusively, to vehicle infotainment. When considering the potential sale of BlackBerry patents, whether QNX and its patents would be part of the deal, and what the impact on BlackBerry's valuation would subsequently be, is an interesting area of discussion.

BlackBerry has other interesting company acquisitions. For example, it acquired Certicom which owns over 200 patents in the security space, including the well-known elliptic curve cryptography (ECC) used in security public-key generation. Other examples include: Torch Mobile which became the web browser in BlackBerry 7 and 10, The Astonishing Tribe (TaT) which contributed heavily to the BlackBerry 10 graphical user interface “Cascade,” and many other acquisitions in the social media, VoIP, and video space. However, these companies either do not have substantial patent portfolios or, similar to the QNX case, patents owned by these companies have not been completely reassigned to BlackBerry. BlackBerry’s most recent acquisition is that of Paratek Microwave Inc. (March 2012), a company that focusses on multiband RF tuning technologies for devices. One hundred and fifteen of the Paratek Microwave granted patents had been included in our BlackBerry portfolio analysis.

Overall, BlackBerry’s patent portfolio is substantial in size and contains diverse technologies relevant to today's mobile computing industry. In spite of the negative press and public scrutiny BlackBerry has experienced over the last few years, the inventions that this company has developed should not be overlooked,and are well worth further investigating.