Tracking the market for semiconductors, from the fab floor to the customer’s door.

Editor and Lead Author: David MacQueen

Contributing Authors: Payal Vinayak, Shereen Vaux

![]()

Industry Observatory

Tracking the key news stories.

Apple iPhone 15 launch

- Consumers will notice improved camera array (Sony), Lightning connector replaced by USB-C due to the EU directive aimed at reducing e-waste.

- Significant improvements “under the hood” with some notable firsts

- First mass market 3nm CPU (A17 Pro), fabricated by TSMC.

- First D1β DRAM, supplied by Micron.

Huawei Mate 60 Pro launch

- SMIC 7nm (N+2) process found in the HiSilicon Kirin 9000s processor.

- First 100% Chinese made 5G modem.

- SK hynix D1z DRAM and 176L NAND chips also present.

Geopolitics: A tale of two handsets

- Despite the advanced technology in the iPhone 15, the Mate 60 Pro was a bigger story. “Are sanctions working?” was the question asked by the mainstream media.

- Mate 60 is a yardstick for semiconductor development in China, instead of a warning that sanctions are failing.

- The presence of SK hynix chips in the Mate 60 Pro raises questions.

AI

- Nvidia recorded stellar results, driven by demand for its AI chips. Data center revenue was up 171% year-over-year to over $10 billion in Q2.

- AWS announced an investment of up to $4 billion in generative AI company Anthropic.

Future Positioning

- Intel announced that production will start shortly on Meteor Lake, its first chips on the Intel 4 process node which uses EUV.

- GlobalFoundries opened a 23,000m2 fab in Singapore.

- TSMC’s first fab (of two being built) in Arizona was delayed coming online until 2025.

![]()

Under the Microscope

Apple iPhone 15

Apple introduced four new smartphone models, iPhone 15, 15 Plus, 15 Pro, and 15 Pro Max at its Wonderlust event on September 12, 2023. Consumer reviews largely focused on the much-improved camera array from long-term imaging partner Sony. It includes a 48MP sensor across all models— a significant increase of the 12MP camera on the base models of previous generation iPhones. The other change obvious to consumers is that the Lightning connector is replaced by USB-C, due to the EU directive aimed at reducing e-waste.

There are also significant improvements “under the hood” with some notable firsts. Catching much of the industry attention has been the inclusion of the first mass market 3nm process CPU (A17 Pro), fabricated by TSMC. Also of note is the first D1β DRAM, supplied by Micron.

Despite rumors suggesting that Apple may have included its own modem, the iPhone 15 uses a Qualcomm modem, and Apple has reportedly renewed its deal with Qualcomm for a further 3 years.

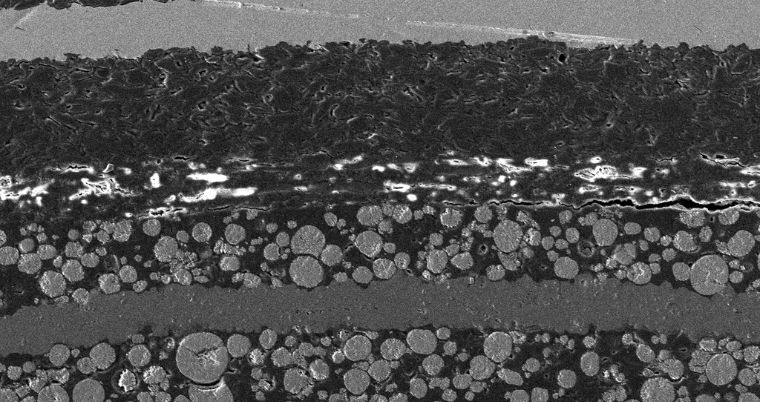

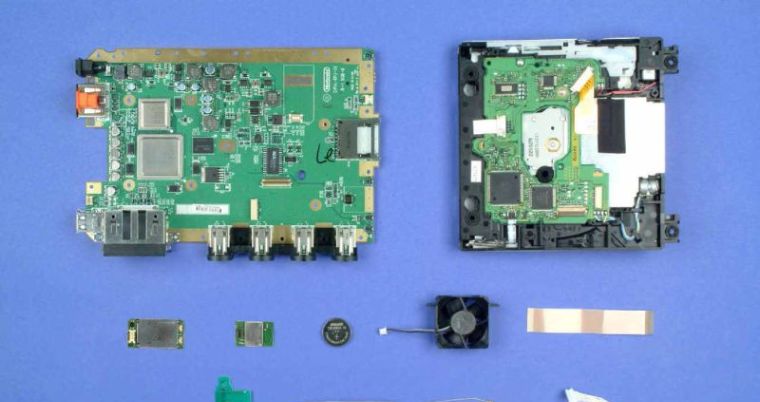

Huawei Mate 60 Pro

Huawei unveiled its Mate 60 devices, including the Mate 60 Pro, which features some notable technology. Of particular interest was the HiSilicon Kirin 9000s CPU, produced by SMIC using a 7nm (N+2) process, marking a technological leap forward from SMIC.

TechInsights found that SK hynix D1z DRAM and 176L NAND memory chips were also present. These are restricted for export to China. SK hynix has announced an investigation to uncover how the Huawei device includes these chips.

The Mate 60 Pro also includes a Chinese made 5G modem. Indeed, most of the components in the device are made in China, other than the camera’s image sensors and the memory.

Geopolitics: A tale of two handsets

Despite the advanced technology and new chip processes in the iPhone 15, the technology in the Mate 60 Pro was arguably a bigger story. “Are sanctions working?” was the question asked by many in the mainstream media.

The processes used for the CPU and the ability to create a 5G modem represent a leap forward from Chinese semiconductor companies. However, the idea that sanctions would mean these companies would stand still, and China be placed in technological limbo, is unrealistic. That almost all the components in the Mate 60 Pro are from China is surely an expected result of the technology sanctions, and that the Chinese government’s “Made in China 2025” policy is largely meeting its objectives (see also our report that this is a trend in the auto vertical as well). The Huawei device is a yardstick for continued semiconductor development in China, instead of a warning that sanctions are failing.

That said, the discovery of SK hynix chips in the Mate 60 Pro does raise questions. The resulting investigations should shed light into how they came to be there.

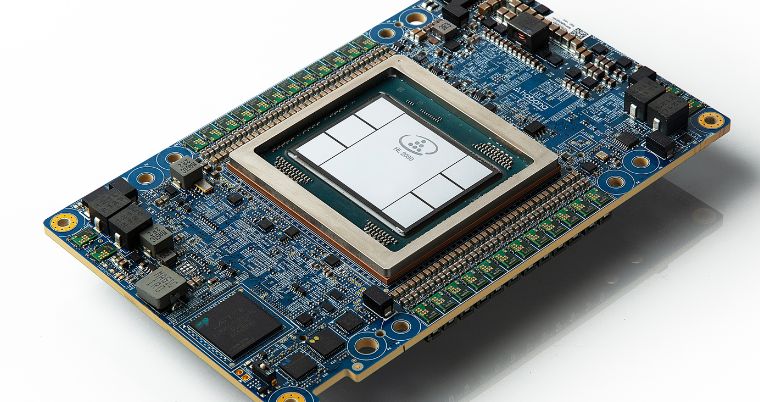

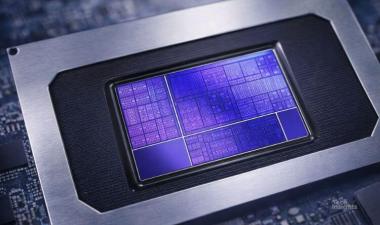

Artificial Intelligence

Nvidia recorded stellar results, driven by demand for its AI chips. Data center revenue was up 171% year on year to over $10 billion in Q2. Nvidia also announced the GH200 Grace Hopper platform with 2 interlinked Grace Hopper chips and HBM3e memory. It will be available in Q2 2024. Reportedly its next generation of GPU architecture, Blackwell B100, will use TSMC’s 3nm process.

AWS announced a strategic investment of up to $4 billion in generative AI company Anthropic. Anthropic’s Claude LLM competes with ChatGPT and Bard. Separately, parent company Amazon is rolling out a custom generative AI LLM into Alexa products for augmenting voice interactions.

Future Positioning

Intel announced that production will start shortly on Meteor Lake, its first chips on the Intel 4 process node which uses EUV. The Intel 4 process should be capable of producing similar results to Samsung and TSMC’s 3nm processes. The switch to EUV from multipattern lithography also lays the framework for future 2nm-equivalent processes. Intel also announced glass substrates for advanced packaging. The material is aimed at high performance and large form factor packages, such as AI datacenter chips.

GlobalFoundries Technology Summit saw the company talk up successes in its “essential technology” strategy, such as low power edge compute and automotive. The company also opened a 23,000m2 fab in Singapore, and is in discussion for a potential $8 billion investment in its plant in Dresden, Germany.

TSMC’s first fab (of two being built) in Arizona was delayed coming online until 2025; however, the company is reportedly in talks to invest further in the state and open a packaging plant alongside the fabs.

ARM’s IPO was also a major industry event last month, but it represents an exit by SoftBank rather than an injection of capital into ARM.

![]()

Data Observatory

TechInsights’ at-a-glance health check on the pulse of semiconductor manufacturing.

This chart shows trailing 12-month data for fabrication equipment sales versus integrated components revenues, overlaid against capacity utilization.

- Order activity for semiconductor equipment increased.

- Memory inventories, while improving, are still running two times higher than the norm. We expect a challenging business environment for memory manufacturers for at least another quarter.

- Memory spot prices are starting to increase, signalling improving market fundamentals.

TechInsights’ weekly TCI Graphics data stream offers market share and forecast data for the semiconductor industry. TCI Graphics brings you the power of nowcasting.

![]()

Editorial

Sustainability

Sustainability is the broadest reaching challenge facing the industry, affecting every company in the supply chain and almost every aspect of business. Sustainable investing, once a niche activity, has become mainstream. Some of the world’s largest investors, most notably pension funds, have made this a core part of their investment strategies. Coincident to this, regulators and stock exchanges are implementing regulations requiring companies to make climate related disclosures. SEC rules on ESG will come into effect shortly, bringing the US into line with European exchanges.

Demand from consumers for more eco-friendly end products and devices are driving shifts across the supply chain. Device vendors such as Apple are keen to demonstrate their green credentials to entice consumers, and so their suppliers must meet more stringent environmental requirements. International agreements to reduce carbon emissions are changing government policy through a combination of investments, incentives and, at the other end of the spectrum, outright bans – such as the coming bans on internal combustion vehicles in many markets.

Many companies across the semiconductor value chain have committed to sustainability targets. As in any ecosystem, including those we would aim to protect, the actions of each company impacts the others. There has been for some years a growing acknowledgement that companies must take responsibility for sourcing products, as well as how they are used further upstream. Indeed, ESG frameworks for emissions take into account the supply chain.

Today, this change across the entire supply chain is happening. More efficient equipment from vendors such as ASML (who have committed to zero emissions by 2025) helps foundries such as TSMC (net zero by 2050) meet their environmental targets. In turn, this helps consumer electronics companies such as Apple (carbon neutral by 2030) achieve their goals. Companies are choosing partners based on how they can help them fulfil targets for carbon usage, or other environmental targets such as supplying components using recycled materials. Sustainability initiatives are not just about doing good, but also about doing good business.

With such a broad set of impacts across multiple industries, it can be difficult to make sense of it all. TechInsights’ research can help identify those areas where a business can make meaningful change and make the most of the opportunities available at a time of broad societal shifts.

![]()

Special Feature

Sustainability

Sustainability in Semiconductor Manufacturing

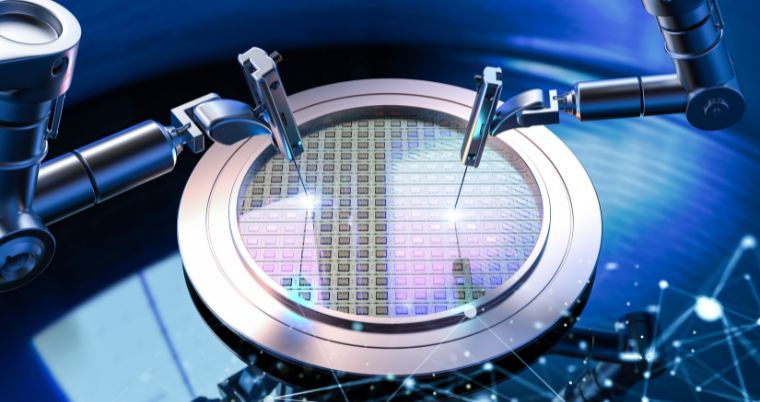

The TechInsights Semiconductor Manufacturing Carbon Model, the first of its kind, brings together the equipment, processes, and manufacturing steps for Logic, DRAM, and NAND into one model for leading 300mm wafer fabs.

Sustainability in manufacturing underpins sustainability across the entire value chain. Price and performance are no longer the only buying criteria.

Electric Vehicles

The transition to EVs forms a cornerstone of government initiatives to fulfil international obligations on carbon reduction. This is a change already well underway. Not only can the shift to EVs help companies meet carbon goals, it also represents a sizable opportunity for the semiconductor industry.

Circular Economy

The lifecycle of devices does not end once the first owner finishes with their use. Refurbished devices, particularly smartphones, have increased in popularity recently. Consumer behaviour has been influenced not only through environmental concerns, but ongoing economic uncertainty. Recycling devices and reusing the metals and other materials contained within them is also of increasing importance.

Power and Battery

Closely tied into the circular economy are batteries. They are challenging to recycle, but toxic if sent to landfill. One of the greatest worries that consumers have with refurbished devices is the battery performance of the device they will receive.

Batteries, and other power semiconductors, also have a key role to play in the transition to electric vehicles. Again, battery life (expressed in vehicle range) is a key consumer concern.

TechInsights recognizes the crucial role batteries have in sustainability and are developing a battery model that will capture the carbon footprint and life cycle assessments of lithium-ion batteries used in consumer electronics. Another future product, NAND Power & Lifecycle analysis will determine power consumption and the impact of the wear on the underlying NAND flash memory within both Enterprise and Consumer SSDs.

![]()

Company Profile

Observing ASML

History

ASML was founded in 1984 as a joint venture between ASM and Philips to develop lithographic systems for semiconductor manufacturing. In 2022, ASML’s revenues exceeded the combined revenues of its parent companies. How did it achieve such success?

After a troubled start, in 1991 ASML released its PAS 5500 lithography platform (still in use today) which propelled it from a cash-hungry R&D startup into profitability. An IPO followed in 1995, making ASML an independent company. In 2010 ASML shipped the first EUV lithography tool which laid the foundations for its success today.

ASML remains the only company to have commercialized EUV lithography, and EUV is the only commercially viable technology capable of 5nm and lower processes. ASML’s importance to the semiconductor industry can hardly be overstated; every advanced consumer electronics device from smartphones to AI servers are built using its tools.

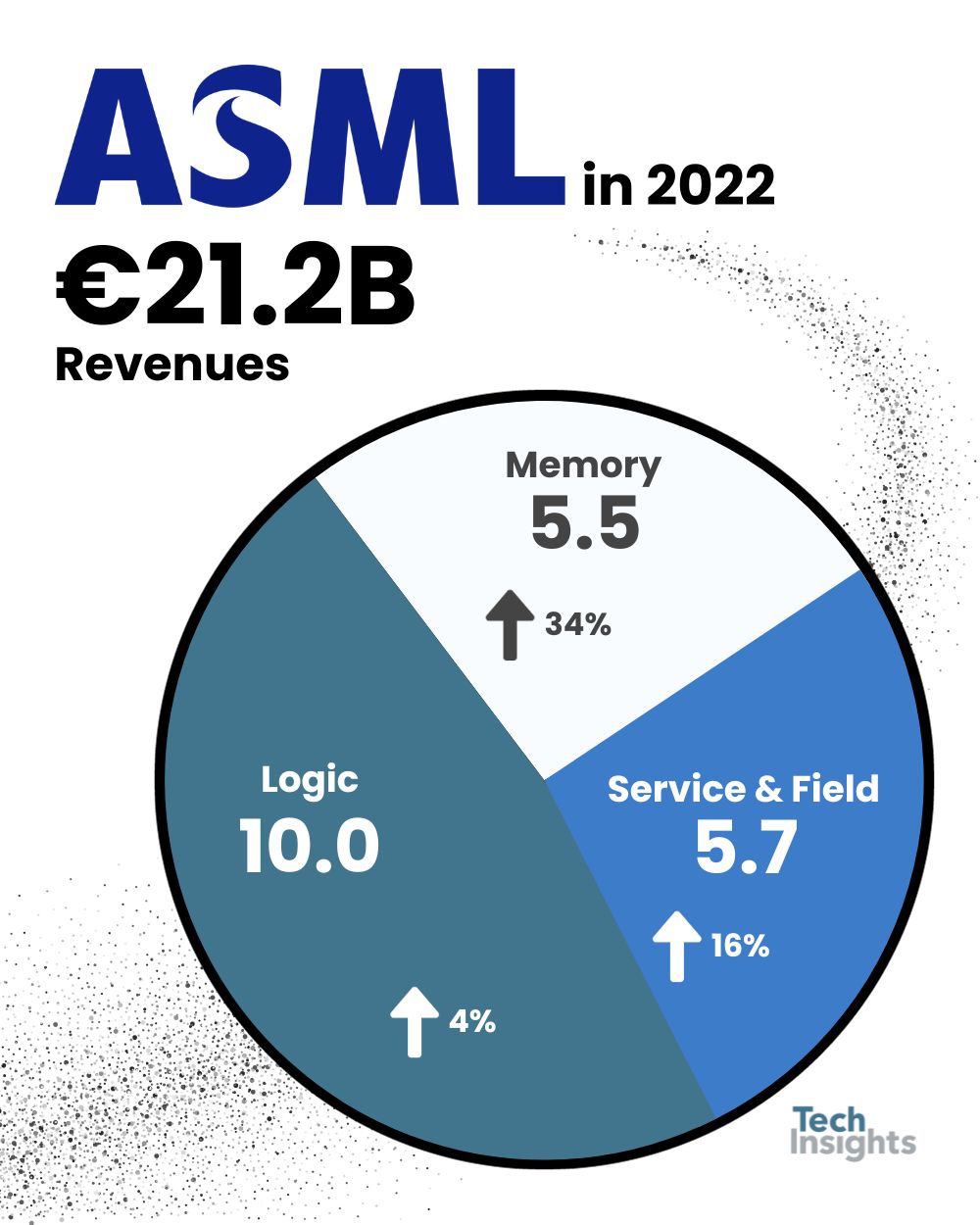

ASML in numbers

2022 was a record year for ASML’s revenues, with total net sales increasing 13.8% compared to 2021.

System sales make up the bulk of ASML’s revenues. Strong end-market demand for servers drove memory systems sales, while for Logic systems demand to support 5G devices and AI were the key drivers. Although ASML enjoys a unique position in the market for EUV tools, it is the previous generation (DUV) systems which are the main sources of revenue and profitability. Of the 345 lithography systems shipped, 40 were EUV systems.

The global chip shortage in 2022 accelerated ASML’s service and field revenues. Increases in end-market demand also increased demand to support systems used in its ongoing operations, enhance productivity, and extend the lifecycle of existing systems.

R&D spend rose from €2.5 billion to €3.3 billion. ASML continues to invest in EUV to maintain its leadership position and drive ever-smaller scale processes. Other R&D spend is mainly centered on improving customer productivity. Research includes enhancing DUV processes to increase “good wafers per day,” along with metrology and multibeam inspection tools.

Sustainability

ASML has taken a strong stance on sustainability and is committed to reducing the environmental impact of its lithography solutions. With a strong focus on climate action, ASML aims to reach net-zero greenhouse gas emissions across its operations by 2025, extending this goal to its supply chain by 2030 and product use by 2040. Its strategy includes reducing energy consumption, prioritizing renewable energy use, and offsetting residual emissions.

ASML is also dedicated to promoting a circular economy and aims to eliminate waste sent to landfills or incineration by 2030. Its approach involves understanding and managing resource flows, redesigning processes to minimize environmental impact, extending product lifetimes, reusing resources within its value chain, and recycling materials when reuse is no longer feasible.

ASML Deep Dive

![]()

Interesting Observations

Curated highlights of the top reports published on the TechInsights platform in the past month.

This month we highlight the continued consumer shift in vehicle purchasing with results from our latest consumer survey. Also in the automotive sector, TechInsights attended the IAA Munich Auto show this month and some key takeaways are in our report. Finally, our analysts were once again in attendance at a Qualcomm event for the next generation of Wi-Fi technology and gave insight into the device categories where we can expect to see it deployed first.

![]()

Retro Tech

Test your industry knowledge

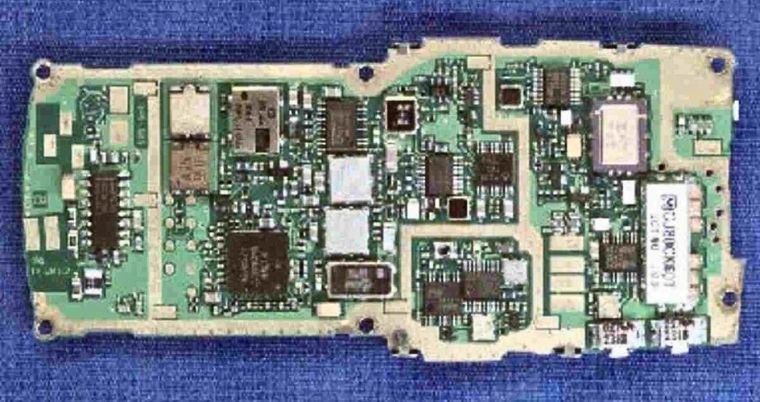

Can you identify these retro devices?

Click on the image to go to the teardown on our platform and see the answers.