Intel's Three-Pronged Recovery Plan

Ongoing Efforts in Fab, CPU, and AI Could Reach Market in 2025

As Pat Gelsinger begins his fourth year as Intel CEO, his efforts to revitalize the company remain unrealized. Progress continues on its five-nodes-in-four-years plan to regain the lead in transistor manufacturing, but the biggest steps lie ahead. Less well known is a program to develop a new CPU microarchitecture that aims to reverse Intel’s deficit in performance and efficiency relative to AMD’s Zen CPUs. A third project combines aspects of its Habana and Xe GPU architectures to create an AI accelerator that will compete with those from industry-leader Nvidia. Together, these efforts could restore Intel’s technology lead, but they won’t reach the market until 2025 or later.

In the meantime, the company’s products continue to come up short. The Intel 4 process recently reached volume production, more than a year behind TSMC 4nm. Intel 4 is available in only one product that serves about a third of PC segments; buyers of desktops and premium laptops, as well as server customers, remain on 7nm. For more than two years, Intel has made minimal changes to its CPU microarchitecture. Its AI accelerators can’t match the performance of Nvidia’s H100, which was released back in 2022, and have gained little market share.

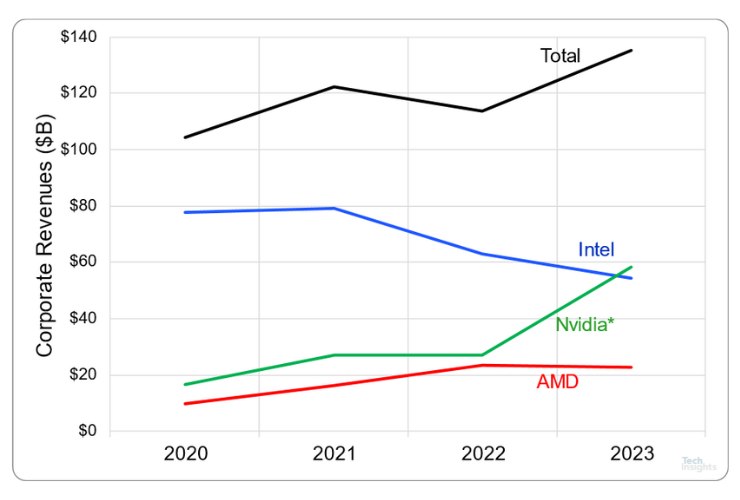

Figure 1. Corporate revenue for leading vendors of PC/server chips. Since Pat Gelsinger became Intel’s CEO in early 2021, Intel’s revenue sank while AMD’s and Nvidia’s soared. Intel’s revenue as a portion of the total dropped from 75% in 2020 to 40% in 2023. *Nvidia’s revenue shifted by one month due to its fiscal reporting; Q4 2023 is estimated. (Source: company financial reports)

These weak products have hurt Intel financially. In the year before Gelsinger became CEO, the company’s revenue was $78 billion and its net profit a robust $21 billion. In 2023, revenue dropped to $54 billion, and the company barely eked out a profit. During the same period, AMD and Nvidia added a combined $55 billion in revenue, as Figure 1 shows, suggesting that Intel’s decline is due mainly to loss of share rather than reductions in PC and data-center spending. In the ultimate insult, Intel’s stock-market value is now less than AMD’s (and far below Nvidia’s). Thus, the efforts to reinvigorate its technologies are essential for Intel to regain market share and financial strength.