Tracking the market for semiconductors, from the fab floor to the customer’s door.

Editor and Lead Author: David MacQueen

![]()

Industry Observatory

Tracking the key news stories.

CHIPS and Science Act

- First deals from the total $53 billion package were announced.

- The first private companies to receive funding are BAE Systems ($35 million), Microchip Technology ($162 million), and GlobalFoundries ($1.5 billion).

- $5 billion was assigned to the National Semiconductor Technology Center (NSTC), a new public–private consortium to support innovation

First High-NA tools ship from ASML

- ASML delivered its High-NA tools to Intel’s Oregon facility in early January, and by late February Intel achieved the “first light” milestone.

- TSMC and Samsung are set to receive the tools later this year.

2023 full year results are in

- ASML overtook Applied Materials as the world’s largest semiconductor capital equipment vendor.

- Intel ($54 billion revenues in FY 2023) was overtaken by both TSMC ($70 billion) and NVIDIA ($61 billion) and become the third-largest semiconductor company by revenues. It is closely followed by Samsung’s semiconductor division ($51 billion).

Artificial intelligence

- Sam Altman, CEO of OpenAI, is reportedly looking to raise between $5 trillion and $7 trillion for an AI chip initiative.

- NVIDIA launches a personal chatbot that runs on its RTX graphics cards and a private enterprise AI service. The company is reportedly setting up a custom chip division to design AI chips for hyperscalers and other AI cloud providers.

- Intel will fabricate custom chips for Microsoft on its upcoming 18A node in a major deal for its Intel Foundry division.

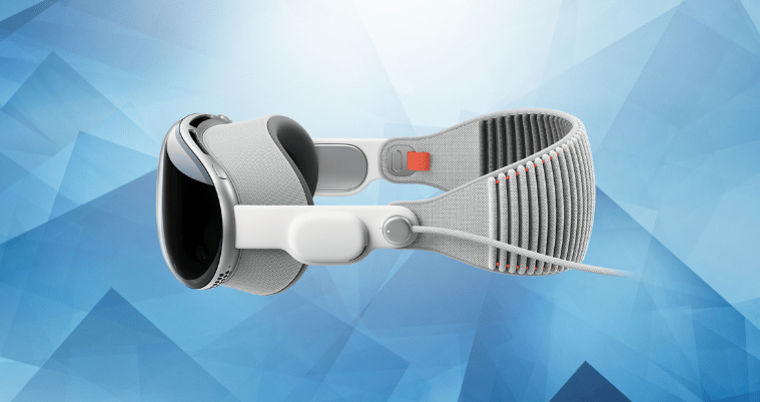

Apple Vision Pro

- The spatial computing device began shipments in early February.

- Our analysis shows that it includes 12 cameras (all but one from Sony), and the device includes a novel R1 chip for preprocessing data from the cameras and the array of other sensors.

![]()

Under the Microscope

The last couple of months in 2023 saw a lot of activity around the continuing megatrends of geopolitics and AI, but arguably the most immediate, impactful trend was the strengthening industry recovery and a renewed optimism from all players about the coming year. The PC chip market also saw some interesting changes that will set that sector up for a dynamic 2024.

CHIPS and Science Act

The first deals from the over-$50-billion package were announced. BAE Systems received the first grant, $35 million to support the modernization of the company’s Microelectronics Center. Microchip Technology is to receive $162 million split across two projects: $90 million to modernize and expand a fabrication facility in Colorado and $72 million to expand a fabrication facility in Oregon. The largest award to private enterprise went to GlobalFoundries, which was awarded $1.5 billion to support a new state-of-the-art facility and the modernization of its manufacturing sites in New York and Vermont.

Of the $11 billion earmarked for research and development, $5 billion was assigned to the National Semiconductor Technology Center (NSTC), a new public–private consortium to support innovation. The government also announced a further $300 million earmarked for packaging research, opening applications for funding from the industry.

Tools and Fabrication

Intel was the first customer to receive High-NA (numerical aperture) tools from ASML, which were delivered to its Oregon facility in early January. By late February the company achieved the “first light” milestone to allow testing to begin. Intel does not plan mass production using High-NA tools until around 2027 when the tools will be used in its 14A process. Competitors TSMC and Samsung are set to receive High-NA tools later this year.

2023 Full-Year Results Are In

Full-year 2023 results from across the industry confirmed new leadership positions in the overall semiconductor industry and in capital equipment. TSMC became the world’s largest semiconductor firm, with revenues of just under $70 billion, and NVIDIA took second place with $61 billion. Intel’s slide continued, pushing the company from market leader last year to third place with $54 billion, closely followed by Samsung’s Semiconductor division with revenues of $51 billion.

ASML overtook Applied Materials as the world’s largest semiconductor capital equipment vendor. ASML’s 2023 revenues were €27.6 Billion (USD 29.8 billion), compared to Applied Materials’ revenues of $26.6 billion.

Artificial Intelligence

Sam Altman, CEO of OpenAI, is reportedly looking to raise between $5 trillion and $7 trillion for an AI chip initiative. The sum proposed is not only larger than the entire existing semiconductor industry (which we expect to reach $1 trillion in value by 2033) but also exceeds the annual gross domestic product (GDP) of the world’s third-largest economy (Japan). This may not be the best time to go looking for such a large sum of funds from investors. The fallout from his ousting and subsequent reinstatement as CEO continues with the US Securities and Exchange Commission beginning an investigation. Elon Musk is also suing Open AI, accusing it of working for the profit of Microsoft rather than acting as a nonprofit and for not sharing the source code to its technology.

As we had predicted would be a trend this year, AI is getting smaller, and the behemoth that is NVIDIA is leading the charge. The company has launched a personalized chatbot that runs locally on its RTX graphics cards and has launched an enterprise private AI service. The company is also reportedly setting up a custom chip division to design AI chips for hyperscalers and other AI cloud providers.

Intel is to fabricate custom ASICs for Microsoft on its upcoming 18A node in a major deal for its Intel Foundry division. The exact nature of the products was not disclosed but Microsoft made an earlier announcement that it was developing its own AI accelerator chips.

Apple Vision Pro Launch

The much-anticipated Apple Vision Pro headset launched on February 2, 2024. Priced at $3499, it’s likely to be a low-volume device, but media interest in anything Apple launches means it is likely to reignite what has been a stalled extended reality (XR) marketplace. TechInsights’ teardown analysis is in progress at the time of writing but has already yielded some key insights. Major design wins are from Sony, which provides 11 of the 12 cameras of the device (the other is from STMicroelectronics). The signal data from the 12 cameras and 11 other sensors in the device are preprocessed by the new R1 chip, which sends a compressed data stream to the M2 CPU.

The device launched shortly before Apple closed its Project Titan, or Apple Car, project. However, Apple may not be entering another new market with hardware, but its Apple CarPlay continues to evolve, and the company will address the auto market through software and services.

![]()

Data Observatory

TechInsights’ at-a-glance health check on the pulse of semiconductor manufacturing.

TechInsights’ weekly TCI Graphics data stream offers market share and forecast data for the semiconductor industry. TCI Graphics brings you the power of nowcasting.

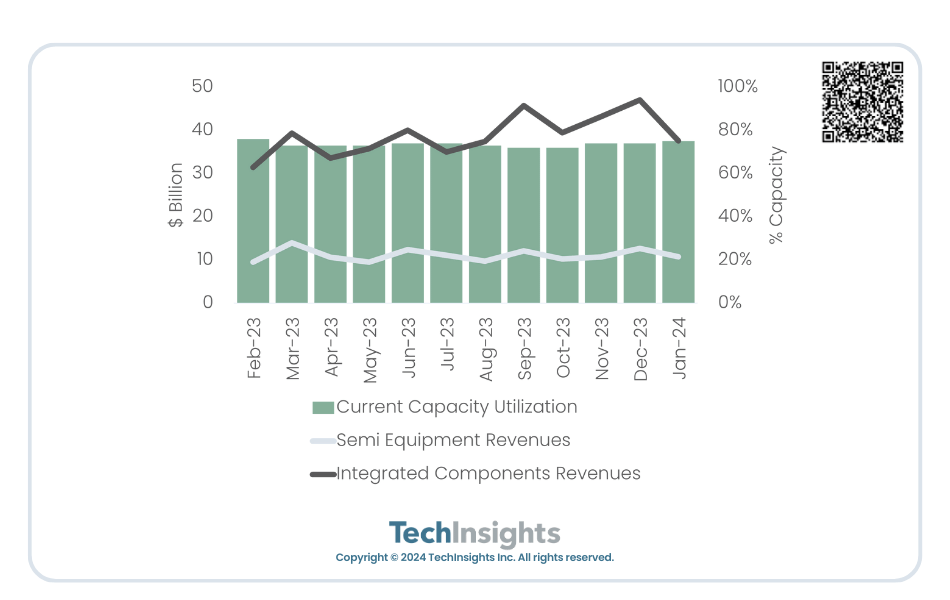

This chart shows trailing 12-month data for fabrication equipment sales versus integrated components revenues, overlaid against capacity utilization.

- Integrated circuit sales are set to surge further in 2024 and we are anticipating a 24% increase in sales this year.

- The major driver is memory, which is expected to surge by 71%.

- Memory pricing has been stronger than anticipated due to increasingly limited inventories and surging demand.

![]()

Editorial

CES 2024 Highlights

CES in January kick-started the year in its usual over-the-top fashion. TechInsights was there in force with the largest team we have ever sent to an industry event. Fittingly for Las Vegas, we sent 13 (an unlucky number for Vegas) analysts who tired themselves out, collectively walking hundreds of miles, seeing countless new products at the exhibitor booths, and conducting over 250 meetings.

Our team saw a proliferation of AI on device, from NPUs and GPUs being integrated into PC to use cases in automotive and televisions. Electric vehicles got practical, with a much greater presence from industrial vehicle OEMs at the show. We also saw a lot more content providers at the show, as the business of TV becomes more complex with OS, apps, and hardware intertwining. In the wearables space, although Apple was absent, other XR vendors were keen to remind the world that the Vision Pro is not the only game in town. We also saw plenty of traction around hearables.

AI was Everywhere

As a consumer show, the focus wasn’t on hardware, such as the H100 server GPUs, but on personal devices. AI is proliferating out to the edge and on-device solutions are appearing across many device categories as companies showed a combination of useful AI use cases and desperate attempts to jump on the AI bandwagon.

The current darling of AI, NVIDIA, announced its new graphics cards, the GeForce RTX 40 SUPER series. Once a device exclusively for high-end gaming graphics, graphics cards have broadened their utility as AI broadened its use cases. Cryptocurrency, on-device generative AI, photo and video editing, and unique AI nonplayer characters in games were among the use cases demonstrated by NVIDIA.

Nvidia’s longtime competitor in this space, AMD, launched its new Phoenix desktop PC chips with a dedicated AI engine, integrated NPUs (on some models), and integrated graphics with Radeon GPUs based on the RDNA3 architecture. Intel and Qualcomm were also showing their latest offerings for desktop processors, although both were announced late last year. Intel’s 14th generation Core Ultra (also known as Meteor Lake) and Qualcomm’s Snapdragon X Elite both feature NPUs.

Intel’s processors, like AMD’s, are x86 architecture cores, but Qualcomm’s offering heralds the first serious competitor to the x86 Windows PC architecture as it is Arm based. Qualcomm’s performance per watt is a key differentiator, and the company is touting the possibility of multiday battery life for notebooks and laptops. Arm architecture may prove a strong competitor to x86 for devices where battery life is a selling point.

Automotive

AI was also everywhere in the automotive space. OEMs BMW, Mercedes Benz, Volkswagen, and Sony Honda Mobility all showcased generative AI assistants for drivers, along with Qualcomm which is offering its generative AI to OEMs as part of its Snapdragon Digital Cockpit platform. AI is also necessary for autonomous driving, and AMD, NXP, and Texas Instruments all launched new system-on-chips (SoCs) for this market. NVIDIA announced many new partnerships and design wins, perhaps most notably with Xiaomi EV, which will use a dual DRIVE Orin configuration.

CES 2024 saw a diversification of EVs, with heavy-duty vehicles aimed at industrial and agricultural segments. Caterpillar showcased an EV loader designed for subterranean mining operations, where the lack of emissions gives EV technology an advantage. The company also had a range of power-generation solutions designed for more remote environments away from electrical infrastructure to power EVs using renewable fuels, solar, or hydrogen cells. Doosan unveiled the Bobcat AT450X autonomous EV tractor, capable of a range of tasks and running continuously through autonomous battery swapping technology. Since such vehicles will not operate on public highways, farming and other industrial segments are good target markets for fully autonomous vehicles that would otherwise face regulatory hurdles.

The premium EV segment is moving toward 800 V and 48 V architectures. With 800 V technology, demand will increase for higher-capacity semiconductors such as silicon carbide (SiC) and gallium nitrate (GaN) products. With thinner gauge wiring, 48 V architectures enable novel control systems enabled by steer-by-wire. Perhaps the most advanced of these is Hyundai Mobis’ Mobion EV concept car, which demonstrated the company’s e-Corner system. Each of the four wheels is controlled independently, allowing the car to move laterally or diagonally and spin on the spot.

Transparent TV, Opaque TV Business

Transparent screen technology isn’t new, and prototypes have been seen at CES before, but this year LG became the first major vendor to launch a transparent TV, the LG Signature OLED T. The 77-inch device will be available later this year at an undisclosed price. For more conventional screens, Samsung was among the few vendors still pushing the 8K format, but with a lack of uptake for 8K from content providers, the company is taking a do-it-yourself approach and leveraging AI. Samsung’s 8K AI Upscaling Pro engine is in all but the most basic 8K model.

A continuing trend at CES has been a shift in focus from hardware only to the business of TV more broadly. Disney and Paramount took exhibition space for the first time this year, despite having no hardware, joining other content providers such as Netflix and NBCUniversal who have attended previous recent CES shows. They are there because the business of television is becoming more complex, and the hardware and software increasingly intertwined. Control of the TV OS is becoming a major battleground. The companies that control the OS control the user experience, and which apps (and therefore streaming services) are available to the end user. Competition is so fierce that some TV OS providers (notably Amazon and Xperi) share advertising and subscription revenues with TV OEMs. Both of those TV OS providers announced new partnerships at the show. Panasonic will use Amazon’s Fire OS, and Panasonic demonstrated the first two Fire TV sets to launch later this year. Xperi’s TiVo OS announced two new partners: Argos and Konka.

Wearables and Digital Health

With the launch of the Apple Vision Pro happening merely a month after CES, other XR vendors were keen to show off their wares and remind the world that this product category isn’t only about Apple. Jorjin, Meta, Nimo, Panasonic, Sharp, TDK, and Vuzix all had XR headsets that showcased a range of different screen technologies and use cases in a still-evolving product category.

Bosch Sensortec demonstrated the BMA580 MEMS accelerometer with tiny packaging at just 1.2 × 0.8 × 0.55 mm. In addition to acceleration measurement, the BMA580 also provides voice activity detection (VAD) using bone conduction. Bone conduction, which relies on detecting vibrations of the user’s skull, offers an advantage over microphones in lower power consumption as it doesn’t rely on “always-on” listening. Although its not a novel concept (indeed the original Google Glass device from 2013 arguably kick-started the XR market used bone conduction) the size and low power of this chip might see some novel devices come to market.

Where it might find a home is in digital health and digital safety. It is estimated that 15% of the 331 million people in the US alone have some type of hearing degradation. CES 2024 saw announcements of several true wireless stereo over-the-counter (OTC) hearing aids including the Jabra Enhance Plus, Sennheiser ADC1, and OrCam Hear. OTC hearing aids are not just in the earbud form factor. EssilorLuxottica announced their Nuance Audio frames, due out later this year.

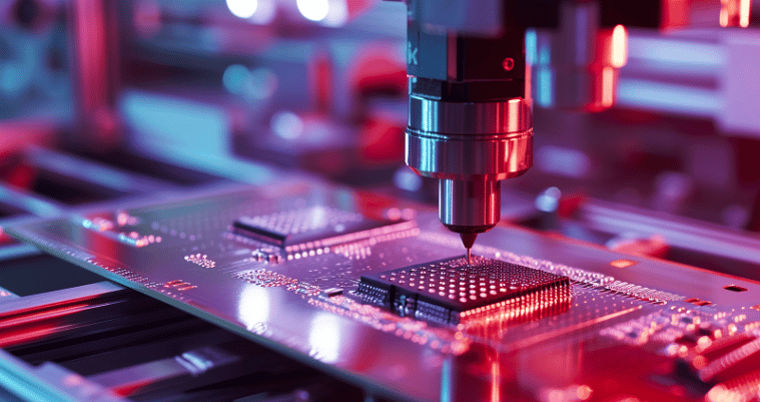

![]()

Company Profile

Observing Intel

Pat Gelsinger, CTO from the times before Intel lost its way and chief architect of one of its most successful processors, returned as CEO in 2021. He has completely revised the company’s strategy in all its areas of business—there is not one part of Intel’s business that does not need to be turned around.

Expensive lawsuits and other litigation have cost it billions financially and diminished its reputation. It missed the high-growth explosion in smartphones. Its x86 architecture is losing ground to Arm (and, to a lesser extent, RISC and RISC-V). The more advanced GPUs of its competitors have seen NVIDIA and AMD overtake it in the data center. Perhaps most importantly, its stalled fabrication process progress has damaged every part of its business. TSMC and Samsung’s foundry capabilities have given Intel’s competitors an edge.

Yet, its CEO aims to return it to a leadership position in 2025. What progress has been made so far?

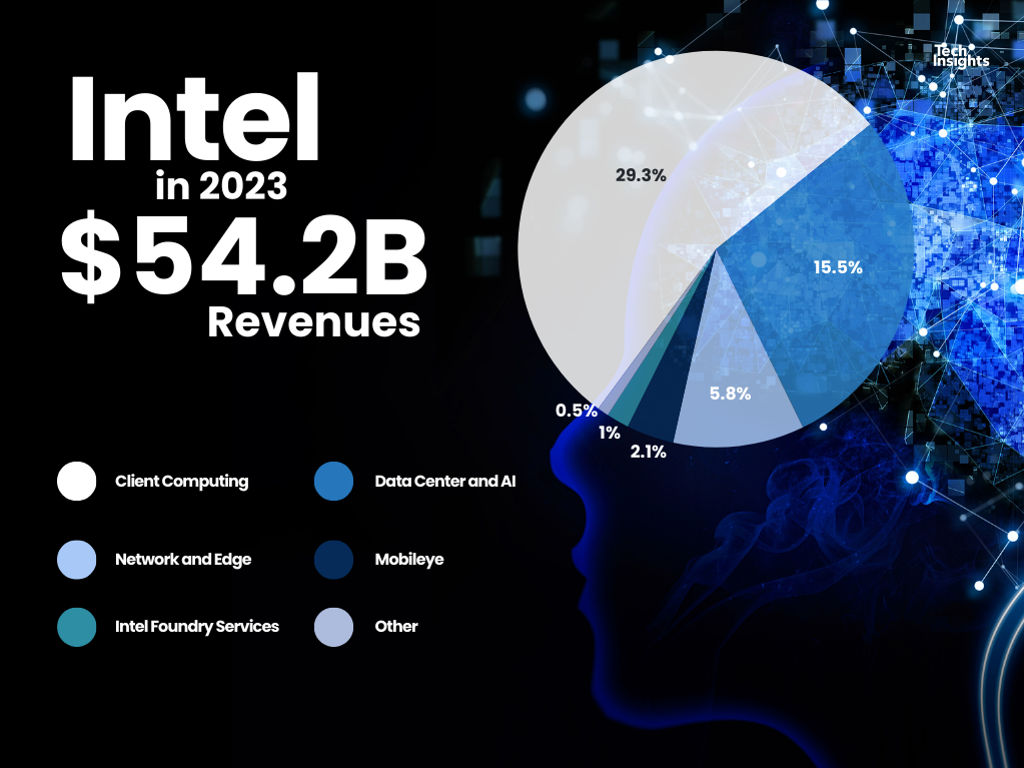

Intel in Numbers

Intel’s 2023 results are the third successive year of declining revenues. A shift from $75 billion in 2021 to $63 billion in 2022, to $54 billion in its latest results indicates a company in dire need of reinvention. Despite this, there is some cause for optimism. Although Intel’s revenues declined 14% in the last year, this is barely different from the overall industry decline of 12%. Intel is no longer losing market share. And the company’s Q4 2023 revenues showed an uplift.

Perhaps, therefore, 2023’s results represent a nadir in Intel’s finances and mark the point at which the incumbent CEO has finally managed to turn around the fortunes of this giant company. Indeed, some of the decline in revenues is due to his efforts to refocus Intel. The company has exited several lines of business, which lowers revenue. Over this time, Intel has exited the memory market completely (although most of its memory business was sold prior to this period), ceased development and sales of its NUC (Next Unit of Compute) or “mini PC” division and its 5G smartphone modem business, and sold its DSG (Data Center Solutions Group) assets to MiTAC.

It would also be unfair to put the blame for the decline over recent years on Gelsinger—the seeds of Intel’s current troubles had been sown before his return.

How Intel Lost its Way

Founded by some of the most notable names in semiconductors and benefiting hugely from the boom times of the PC revolution in the 1990s, Intel was an industry powerhouse. The company’s current CEO, Pat Gelsinger, was a major figure at Intel during that period, leading the design of the i486 processor (the immediate predecessor to the phenomenally successful Pentium). He became the company’s CTO in 2001, but ultimately left in 2009.

The company has faced constant challenges and setbacks since then. Intel’s legal actions and antitrust suits began to give the company a reputation as litigious and aggressive. They have also cost it billions, most notably in its long-running battles with AMD (which began when AMD cloned Gelsinger’s i486 design).

Intel offered its fabs externally for the first time through its Custom Foundry project, which began in 2013. Its manufacturing process progress had stalled almost immediately after Gelsinger left the company. In one of his last public statements as CTO in 2009, he had noted that Intel had a clear path to 10nm. It took a decade before mass production began on Intel 10nm processors. TSMC and Samsung had pulled far ahead.

Intel finally ceased the unsuccessful Custom Foundry project in 2018. The damage to the company was greater than just a failed diversification. Since it uses its own fabrication facilities to manufacture its processors, these two parts of its business are intertwined. Intel’s progress in processors also slowed.

As consumers shifted from home PCs to smartphones and tablets as primary computing devices, the company missed out completely to the likes of Arm and Qualcomm. Intel attempted to enter the smartphone market late, in 2011, with versions of its Atom processor. The higher power requirements of Atom relative to competitors made its offering unsuitable for a market where battery life is critical, and the company exited in 2016.

Recently, the company has come under tremendous pressure in another of its core business areas, the data center. Intel has for decades been the leader in this space. NVIDIA’s, and long-term “frenemy” AMD’s, GPU architectures were well positioned to take advantage of the recent boom in AI. Intel was not. NVIDIA is now the undisputed leader in data-center computing revenues, and Intel is engaged in a two-horse race with AMD for distant runner-up.

A Process of Reinvention

After senior roles at EMC and VMWare, Pat Gelsinger rejoined Intel in 2021, this time as CEO. Underpinning his effort to reinvent Intel across its business is the company’s process roadmap. The strategy of 5 nodes in 4 years was first announced in 2021.

The first of those new processes was the DUV-based Intel 7 (Sapphire Rapids and Emerald Rapids processors for server and Raptor Lake and Alder Lake for client). Intel 7 was previously known as Intel 10nm Enhanced SuperFin (10 ESF).

The second of those processes, Intel 4, uses extreme ultraviolet (EUV), the first Intel process to do so. Intel 4 products started shipping in Q4 2023. In addition to the reduced scale brought about by EUV lithography tools, there was also a significant change in architecture.

Meteor Lake processors are effectively chiplet architectures, which Intel refers to as tiles. The Intel 4 process uses two packaging technologies to integrate the tiles. Tiles are connected using its EMIB packaging for horizontal interconnect and Foveros for vertical stacking (used for cache memory only in Meteor Lake). Despite the progress in its process roadmap, many Meteor Lake tiles (chiplets) are fabricated by TSMC: the GPU, SoC , and I/O tile.

Intel 3 achieved manufacturing readiness in Q4. Sierra Forest and Granite Rapids based chips will start to ship in H1 2024. These families are both aimed at the data center. Intel has not announced any client products for this node. Intel 3 is an evolution of Intel 4. It incorporates no new technologies but improves the density and performance. The company expects processors fabricated on this node to increase performance per watt efficiency by 18% relative to Intel 4.

While Intel 4 was the architecture leap into tiles/chiplets , Intel 20A will be a major leap in the underlying architecture, incorporating new technologies like PowerVia and RibbonFET (GAA). Intel’s 18A will incorporate the Universal Chiplet Interconnect Express (UCIe) standard to allow for easier integration of third-party chiplets. The UCIe specification standard body includes Intel, Samsung, TSMC, and over 100 other major industry players. They expect to achieve manufacturing readiness toward the end of 2024, with products shipping in 2025.

Future Intel processes will use High-NA EUV tools from ASML. The first of these tools was delivered in January 2024 to Intel’s Oregon facility. TSMC and Samsung will both also receive High-NA tools this year. This is another indication that Intel will be a serious competitor for cutting-edge process.

Has Intel Found(ry) Its Mojo?

Reattaining leadership in fabrication is a core part of Gelsinger’s strategy for two reasons. Its own products have suffered from its stalled process, and this represents a route back to leadership in its client and data-center businesses.

The bigger impact is yet to come. Gelsinger is reinventing Intel completely, and the Intel two years from now is likely to look very different to the Intel of today. Intel Foundry, which accounted for under 2% of the company’s revenues in 2023, will become a major line of business in the future.

Progress is being made. Intel announced $10 billion of foundry customer wins booked over the next two years during its results conference call in January, and by the Intel Foundry Direct Connect conference in February, that figure was at $15 billion (although the timeframe for that larger figure was not given). A major customer win is Microsoft for custom ASICs, which we believe to be for AI-related hardware.

To make this a success, Intel must shed its aggressive and litigious reputation. Gelsinger has been unflinchingly positive (in public at least) with his words, attempting to shed that notoriety. Certainly, the partnership with longtime competitor Arm (which will see Intel start to manufacture Arm-architecture chips beginning with the 18A process) is a sign that this is changing. Intel’s willingness to work with partners can also be seen in other aspects of its strategy. Integration of third-party intellectual property blocks through a chiplet approach, its related UCIe interconnect, and opening all aspects of its process capabilities to customers demonstrate that there is a hard technology basis to the new Intel, not just warm words.

Gelsinger’s stated aim is for Intel to be the second-largest foundry by 2030. Intel’s $1 billion of foundry revenue in 2023, compared to leader TSMC’s $71 billion and Samsung’s (approximate) $17 billion, makes this is an ambitious target. However, the announced bookings put Intel on track to achieve this ambition.

Reasons to Be Cheerful

Despite a third year of declining revenues, there are plenty of reasons to be cheerful at Intel’s Santa Clara headquarters—although it’s too early to pop the champagne yet.

Having missed out on the high-growth smartphone market, Intel is attempting to turn that to its advantage, positioning its foundry as a “systems foundry” and giving itself a point of differentiation to leader TSMC . The company is also poised to take advantage of one of the next high-growth opportunities in semiconductors—automotive—through subsidiary MobileEye and the announced (but yet to be completed) acquisition of Silicon Mobility.

When it comes to its revamped Intel Foundry proposition, Gelsinger’s aggressive 5 nodes in 4 years strategy appears to be working. Despite some slight delays to the Intel 4 process, the company remains broadly on track to become a competitive force at minimum and potentially regain a leadership position. A revamped foundry will help Intel with its own products, which the company also sorely needs.

There is a long way to go on all fronts. Intel’s next quarterly results will provide separate reporting for Intel Foundry and will give the industry early insights into what Intel as a company will look like in the future. If Gelsinger’s plans come to fruition, then Intel Foundry will be one of the biggest, if not the biggest, part of Intel, in 2030.

Will Gelsinger be remembered as a talisman with two terrific tenures of this tech titan? Or another meandering manager misdirecting Intel into mediocrity? His first three years have been challenging, with Intel slipping from the top to the third-largest company in the industry. The refocus and investment in process have lowered revenue and margin—Gelsinger hopes that short-term pain will lead to long-term gain. In this particular Game of Thrones, he intends to recapture the throne by befriending rather than beheading (or, rather, suing) other industry players. It will be 2025, and the culmination of the 5 nodes in 4 years strategy, before the world can truly judge the success of Gelsinger’s Intel strategy.

![]()

Interesting Observations

With the Mobile World Congress (MWC) show having just finished, we highlight the world of telecoms.

TechInsights’ analysts covered MWC with a range of preshow reports, live blogs from the show floor during the week, and postevent roundups covering all the major announcements.

TechInsights' Telecom Strategies Group predicts that 2024 offers service providers and enterprise users significant new market opportunities as well as major cost savings and some serious challenges. Major growth opportunities exist for service providers in edge computing and generative AI as well as exciting new use cases enabled by 5G Advanced and especially RedCap devices. In parallel, we expect enterprises to redefine the Metaverse and create real industrial use cases as at the same time AI automates the accelerating Internet of Things (IoT) market. New high-volume silicon and optical components will produce both significant radio-access network (RAN) cost savings and enable the fixed network benefits to deploy ever faster networking. However, serious challenges await many players in the telecom value chain as operators cut back capex spending and the rate of growth of Broadband consumer traffic slows.

The TechInsights Communications Semiconductor Market Share report provides detailed market share and market forecast information that covers the communications semiconductor domain. The subscription provides a text summary analysis of the data presented in table format for more than a dozen product categories and application segments. This offering helps increase customers’ understanding of the chip-vendor ecosystem, enabling more strategic OEM sourcing. It provides access to high-quality market estimates and quantitative data, complementing the technical analyses provided in the Logic Subscriptions with market context Categories include: 10, 25, 40, 50, 100, and 400-Gigabit Ethernet components (FPGAs, embedded processors, server processors and integrated base stations) and Smart-NIC devices.