Posted: June 24, 2014

Contributing Authors: Ray Angers

The US$1.1B takeover bid announced last week by storage solutions heavyweight SanDisk (SNDK.O) for Utah-based Fusion-io (FIO.N) has many suggesting this signals SanDisk’s ambitions to dominate the enterprise segment of the storage market. For a company that posted revenue of just over US$6B last year, this is a big deal. The financial markets responded favourably to the news, but time will tell if the technology acquired helps SanDisk reach their goal.

SanDisk currently owns a significant market presence in the consumer space with a broad array of flash memory and solid-state drive (SSD) products. The addition of Fusion-io, who lists customers such as Apple, Facebook, HP, and IBM, suggests that grabbing more of the enterprise market is a key component to their growth strategy. While this may be a shrewd business move, will the IP that SanDisk acquires from Fusion-io help expand SanDisk’s enterprise market presence?

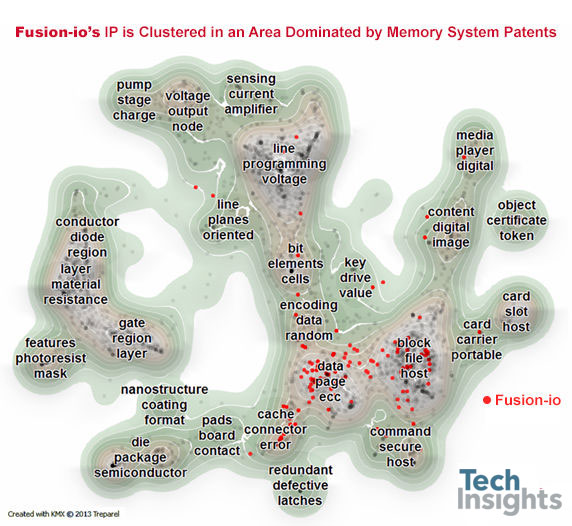

A comparison of patent portfolios for the two companies suggests this to be the case. SanDisk has a broad patent portfolio of about 3500 US grants and applications covering semiconductor fabrication, packaging, circuit design, and memory systems. This is not surprising. The founders of SanDisk were pioneers in nonvolatile memory (NVM) technology. How does Fusion-io fit in? We see their IP clustered in an area dominated by memory systems patents covering data handling, encoding, error correction, cache, controllers, and host interfacing (about 160 US grants and applications highlighted in the landscape below).

This defines FIO’s approach to how they integrate fast NVM hardware with software that manages requests in a high performance server architecture. The result is industry leading IOPS (input/output operations per second) performance, vital to winning in the enterprise storage market. While SanDisk has some experience in this area, the addition of FIO will undoubtedly give them an edge in this market.

With FIO’s share price at an all-time low, the acquisition did not come as a surprise to many market watchers. Indeed, rumours of a potential takeover by other dominant players in this space have arisen in the past – Seagate Technology back in September 2013 for example. Instead, Seagate announced last month its acquisition of LSI’s Accelerated Solutions Division (ASD) and Flash Components Division (FCD) from Avago which will, among other things, strengthen their presence in the PCIe flash space. Similarly, Western Digital, via its SSD subsidiary HGST (formerly Hitachi Global Storage Technologies) ended up acquiring sTec Inc., another noteworthy innovator in the SSD market. With so many players in this market, consolidation was inevitable.

The new combination of SanDisk and FIO is now in a much better position to take on its traditional competitors such as EMC Corp., NetApp, Intel, Micron, and OCZ-Toshiba. And the icing on the cake . . . SanDisk has a new internal customer to supply its flash chips to!

References:

http://uk.reuters.com/article/2014/06/16/us-sandisk-deals-idUKKBN0ER1A620140616

http://seekingalpha.com/article/1925901-can-fusion-io-survive-the-competition

http://www.emc.com/collateral/analyst-reports/esg-wp-emc-flash-strategy.pdf

http://www.forbes.com/sites/tomcoughlin/2013/08/19/the-influence-of-flash-on-enterprise-storage/

https://www.ibm.com/developerworks/mydeveloperworks/blogs/storagevirtualization/entry/1m_iops_from_flash_actions?lang=en

http://www.seagate.com/about/newsroom/press-releases/Seagate-to-acquire-LSI-Flash-Businesses-Avago-PR-Master/

http://www.storagesearch.com/simple.html

http://www.storagesearch.com/ssd.html

http://www.forbes.com/sites/davealtavilla/2014/05/29/seagate-drops-a-bomb-on-storage-industry-buys-lsi-flash-business-from-avago/